We asked shoppers which health conditions they are managing most today, then broke the responses down by generations. The results: members of Gen Z and Millennials are dealing with a range of unpredicted wellness issues. And they’re not all are turning to traditional physicians. Retailers, get in front of this – now.

Millennials or Gen Z Will Decide the Next WELLness Frontier

If members of Gen Z are to follow the Millennial’s path to using health care, then retailers should be on the lookout for shortcuts that could exclude retail stores.

The youngest shoppers tell us, in our How America Shops® research, that they prize speed, convenience and affordability above all else when it comes to the health care services. Trust also is important – but the gaps in trust are changing shopping trends in wellness.

For starters, many of these young shoppers are turning to alternate professionals, not doctors, for their care. Meanwhile, Millennial healthcare patterns suggest this “older” generation also is shirking traditional health options, despite entering their 40s, having children and developing more of their own health conditions.

This presents a rich opportunity for retailers to be what’s next in WELLness.

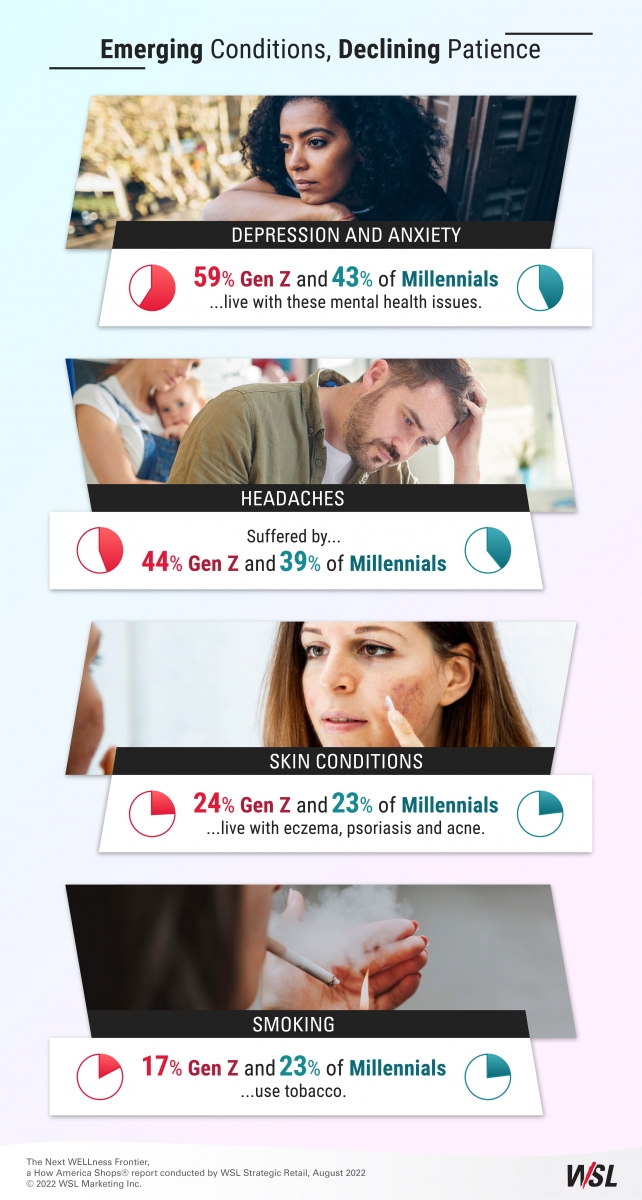

Emerging Conditions, Declining Patience

It may be the health conditions that both Gen Z and Millennials are managing, combined with their demand for ease (especially with kids), that encourages them to seek alternate care providers. Among the surprising wellness issues prevalent among these shoppers, our research shows higher levels of these conditions vs. total population:

Young Shoppers’ Feelings About Health Care Providers: Not Good

We dug deeper into our survey results to gauge shopper sentiments about wellness options, to see if marketing to Gen Z should be the same as marketing to Millennials. This is what we’ve learned, and what retailers should understand about Gen Z’s approach to wellness.

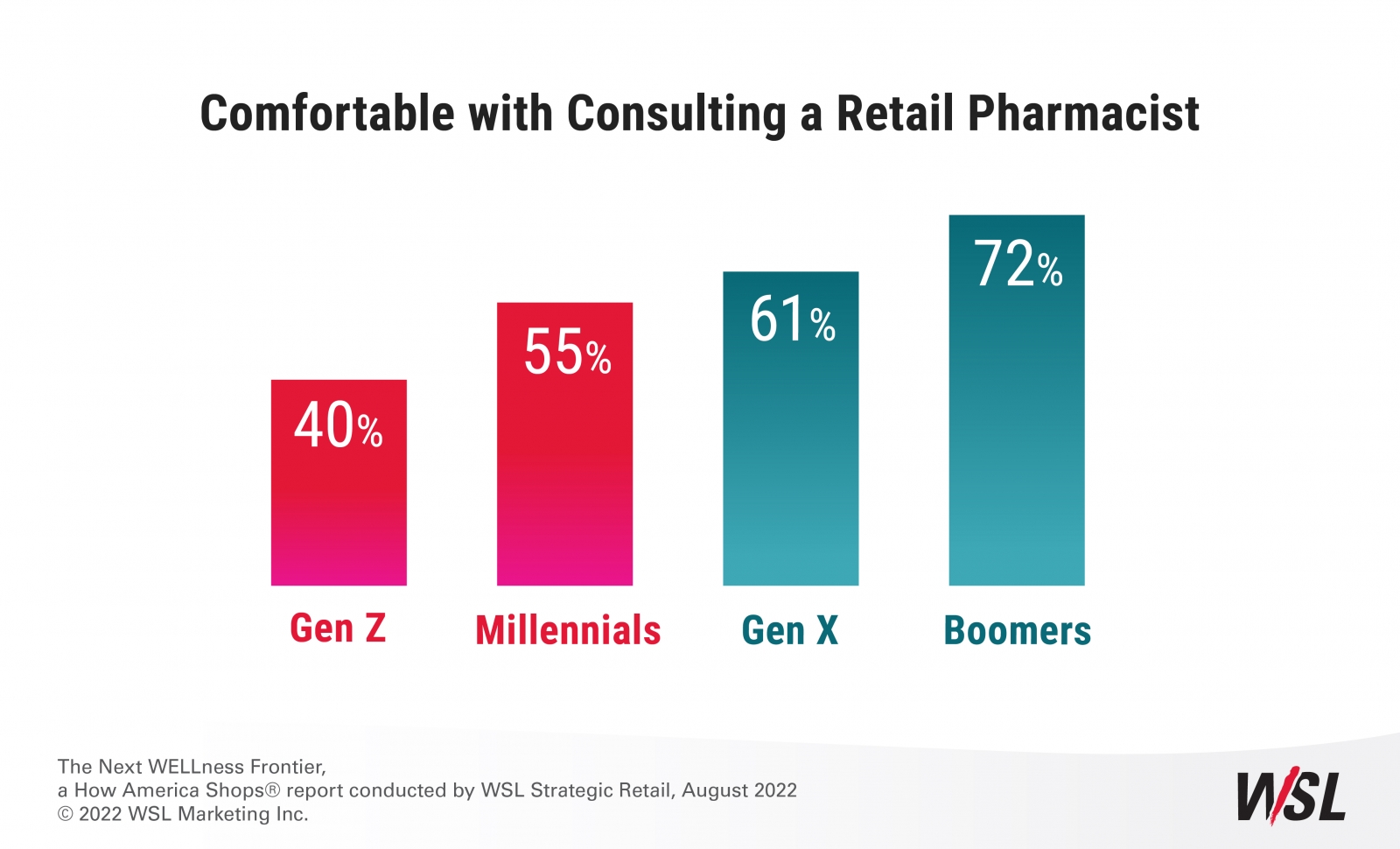

There’s a comfort issue with most traditional health care providers. Fewer Gen Z are comfortable consulting a retail pharmacist, although that level of comfort increases with age:

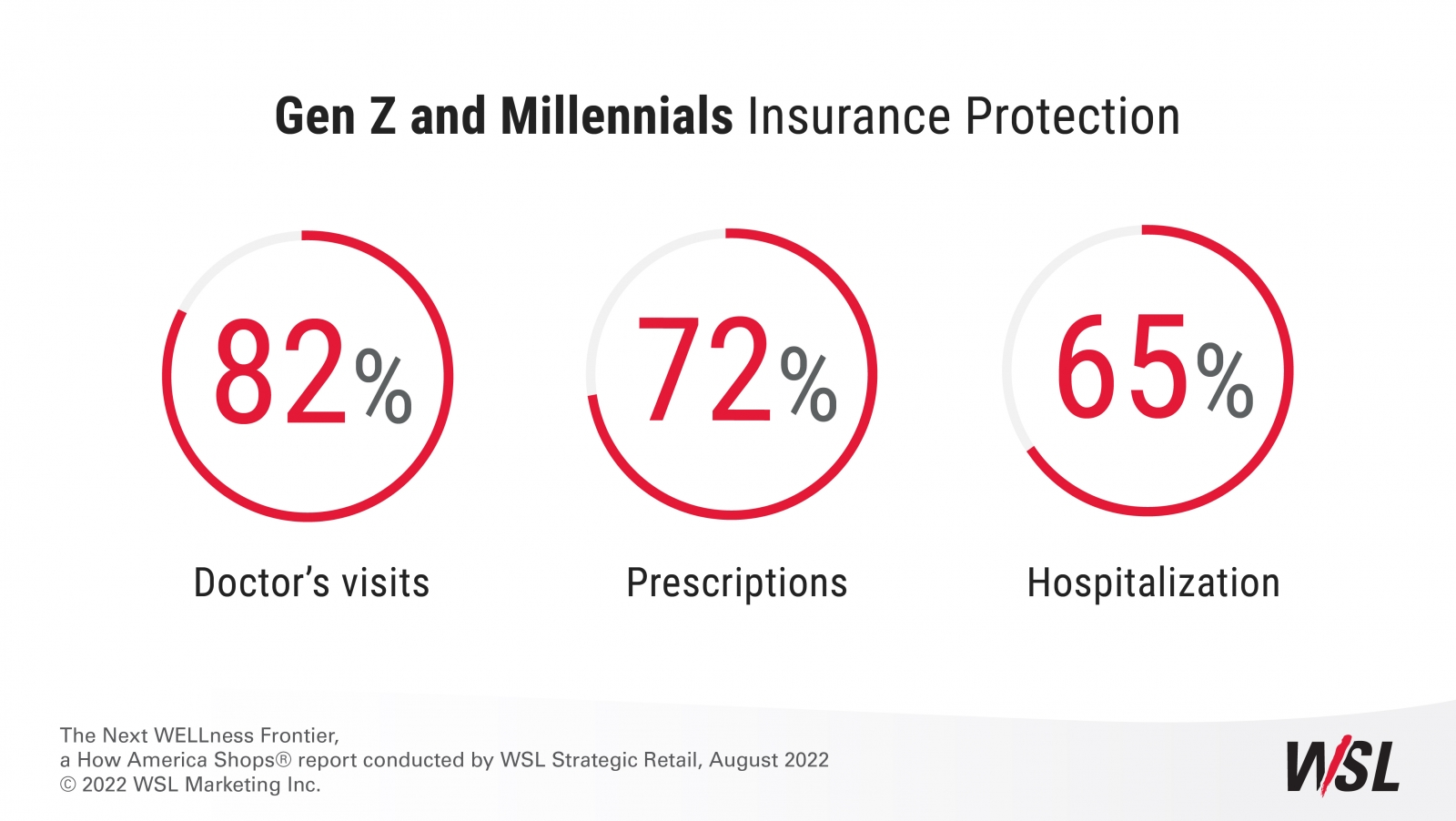

There are generation gaps in insurance. Fewer Gen Z and Millennials have health insurance:

Younger shoppers are more critical about the availability of healthcare, suggesting disappointment with the healthcare professionals and system they experience:

- By 13 percentage points, fewer Gen Z believe their community offers good healthcare options.

- Both Gen Z and Millennials are more likely to neglect checkups and screenings.

Opportunities for Retailers and Brands In the Next Frontier of Wellness

Gen Z and Millennials have another “condition” in common: that their wellness care be fast, easy and affordable. However, our findings suggest members of Gen Z aren’t finding this kind of care from traditional physicians, many of whom have been forced to see patients in 20-minute time slots.

This is not quality care for the shopper. And this is where retailers can step in. Our research highlights three opportunities in particular:

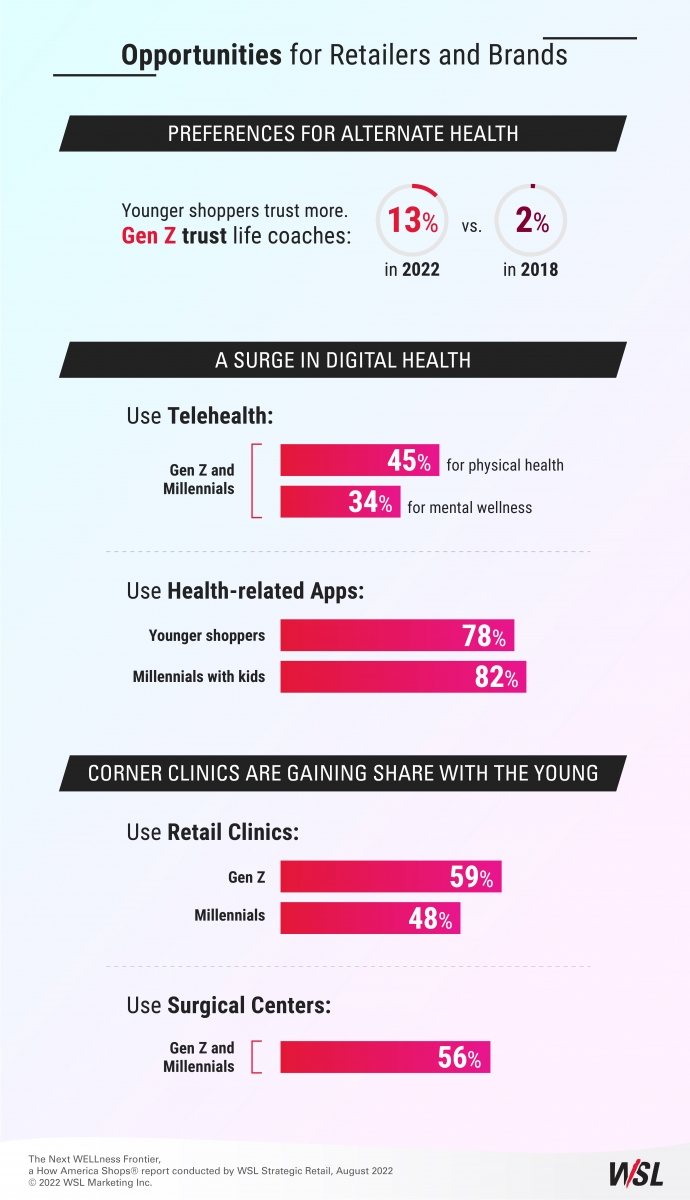

Preferences for alternate health

- Younger shoppers trust massage therapists, acupuncturists, personal trainers and dieticians by at least 10 percentage points more than the overall population.

- Gen Z are turning to life coaches at an increasing clip – 13% in 2022 vs 2% in 2018.

A surge in digital health. Leading digital health services is the path to winning over these patients under 40.

- 45% of Gen Z and Millennials use telehealth for physical wellness, and 34% choose digital for mental wellness. That includes Olympian swimmer Michael Phelps, who supports the digital behavioral tool Talkspace.

- 78% of younger shoppers use health-related apps, and 82% of Millennials with kids manage their health with apps.

Corner clinics are gaining share with the young. Retail giants like Walmart and CVS are stretching to offer more health services.

- 59% of Gen Z and 48% of Millennials use retail clinics

- 56% of both generations use surgical centers, where they find care that is personalized, convenient and lower cost.

Retailers: Make Health Services Fast, Affordable, Personalized

The convenience retail offers is a clear factor in these Gen Z and Millennial healthcare choices – as indicated by Walmart’s plans to open 16 convenient health centers in Florida, and CVS’s intention of offering primary care by the end of the year.

However, earning loyalty takes more than convenience. We suspect these young shoppers feel they don’t get proper respect or attention from traditional physicians. So what’s to lose by trying a retail caregiver?

Retail industry trends should follow the leads of the most influential shoppers when it comes to the big movement toward WELL, and that now includes Gen Z. If the traditional doctor is falling out of favor, then retail is poised to step in.

WSL continuously studies how different generations approach the shopping trip and influence its future path. Subscribers can find breakdowns on shopper sentiments regarding WELLness, inflation and the store’s changing role, here. If you’re not a subscriber, reach out to us to learn about the customized research we can develop for you. this is a test