Generation Z, now one-quarter of the US population, is growing up and providing a fresh glimpse into retail’s future. Here are five factors you need to know about how this generation shops and differs from Millennials.

Generation Z, those born between 1996 and 2011, represents 26% of the total population, according to Nielsen, and its roughly 72 million members are growing up, producing heightened demand for goods and services. That’s not all they call for, however. Their preferences in terms of the shopping experience, from immediacy to clarity, reflect lives that are never without digital devices.

Some call them iGen, and they’re ready to iSpend. Nearly half (49%) of Generation Z are increasing the amount of time they spend shopping, according to our How America Shops® report “Shopping Boom Time.” This reflects their maturing lifestyles, as the oldest of Gen Zs are now in their early 20s.

Brands and retailers must watch them, closely, because how this generation of digital natives interacts with you today offers a view into the future.

5 Gen Z Shopping Habits

Based on our research, we’ve gleaned five important areas that define how Gen Z shops and how the group differs from its cohorts, Millennials. From digital practices to a love of Walmart, here they are.

1. Many Gen Z Shoppers Spend More Time in Stores

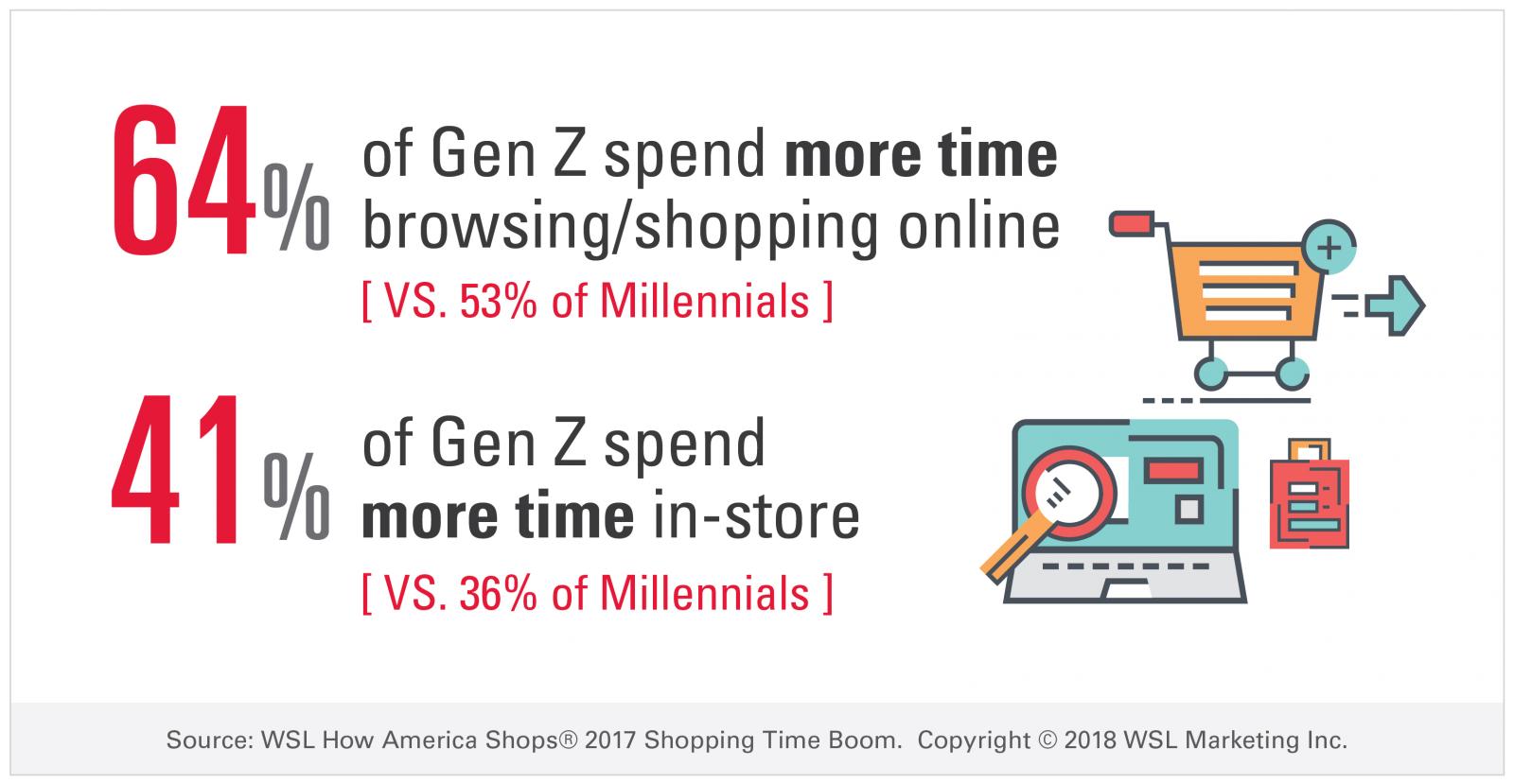

Sixty-four percent of Gen Zs spend more time browsing and shopping online, but 41% have also increased the amount of time they spend browsing and shopping in-store. That beats Millennials, 53% of whom are spending more time shopping online, and 36% in stores. For retailers, online is the opportunistic gateway to getting younger shoppers in-store too – use it to turn young browsers into brand fans.

2. They Prefer Cost-Effective Shopping Channels

After the Internet, most Gen Z shoppers are spending more time in dollars stores (56%) and mass merchandisers (54%). Roughly 40% spend more time in consignment shops and supermarkets. Their preferences imply they are cautious spenders, presenting an opportunity for youth-targeted promotions.

3. They aren’t Loyal to Retail Brands

Generation Z and Millennials share a tendency toward practicality, with the younger cohort spending more time with Walmart, Ulta and local supermarkets (56%, 48%, and 45%, respectively). Millennials have increased their shopping time with Aldi, local supermarkets, and Walmart.

4. They Don’t Buy Into Personalization

While similar percentages of Generation Z and Millennial shoppers are likely to have used personalized offers in the recent past (23% and 25%, respectively), Gen Zs are far less likely to use them in the future – just 28% versus 50% of Millennials, according to our “Restructure Retail” report. This indicates brands and merchants are not doing a good enough job of understanding this segment and what they count as relevant, and personal.

5. Gen Z Shopping Habits Show They’re More Likely to Use Self-Checkout

Nearly 60% of Generation Z shoppers recently used self-checkout, more than any other demographic group. This underscores their comfort level with technology and likelihood of adopting new tech. Millennials, at 51%, were less likely to use self-scanners. Moving forward, more members of each group expected to use the service – 69% of Gen Z and 74% of Millennials.

Understand Gen Z Shopping Behavior, & Catch a Few Zs

Gen Zs are exploring how to spend, and are willing to do so in new, tech-enabled ways, in-store and out. That being said, they still want respect, value and personal service. Now is the time to provide it, before they expand their households. The next generation, after all, is on their heels.